WHAT IS A COMFORTABLE RETIREMENT?

When it comes to retirement, we all would like to have the same income level as we do whilst in employment; that goes without saying. However, the hard truth is that this is far from realistic. Most of as cannot achieve the maximum from a Defined Benefit Pension scheme (Company Final Salary Pension). Where we would look to receive a maximum of 60% of our final salary if we had been employed for 40 years, equal to two-thirds of our salary. Nor are Pension plans readily available in the Offshore market, which means that we have limited choices in what we can do to save for our future retirement.

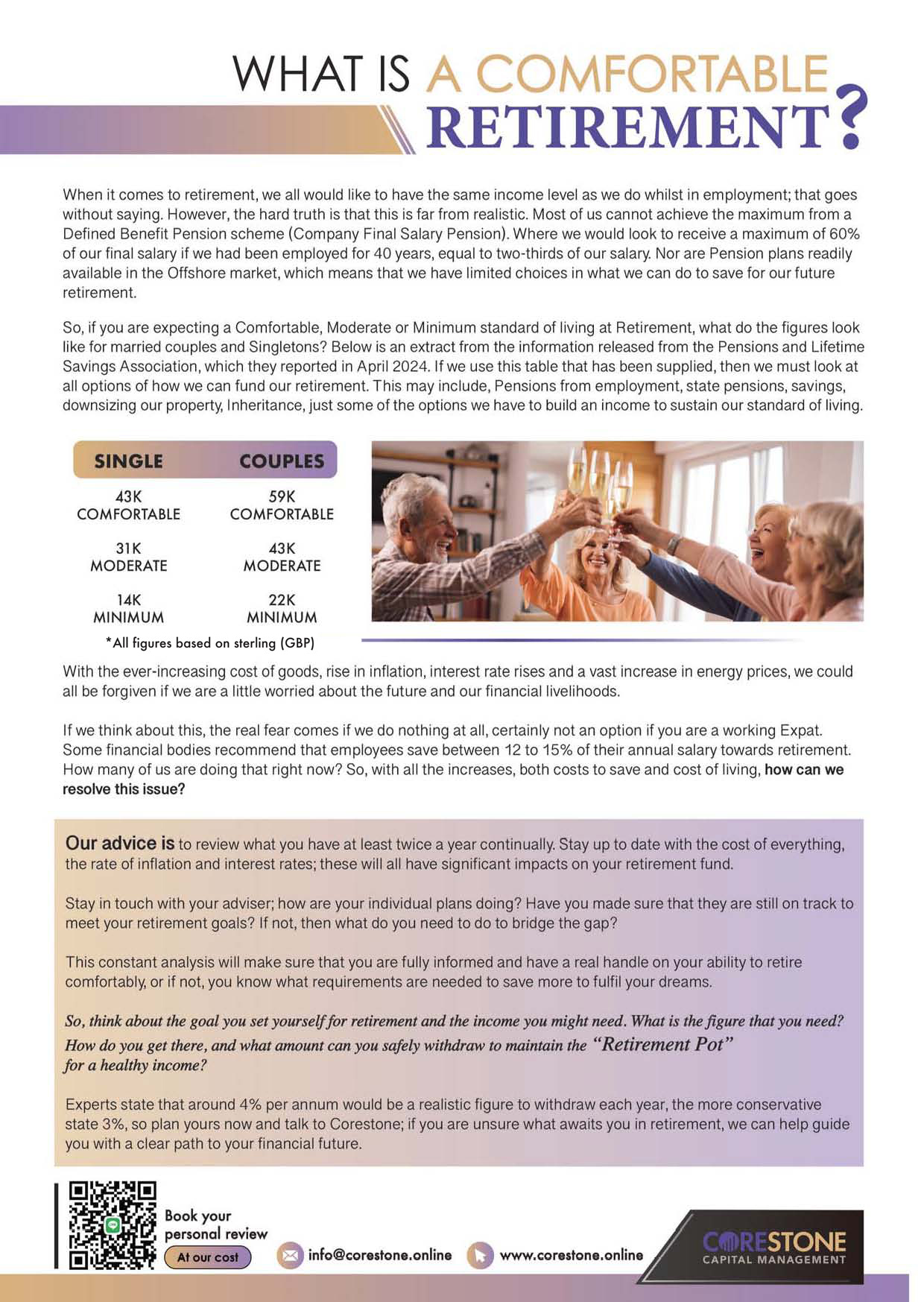

So, if you are expecting a Comfortable, Moderate or Minimum standard of living at Retirement, what do the figures look like for married couples and Singletons? Below is an extract from the information released from the Pensions and Lifetime Savings Association, which they reported in April 2024. If we use this table that has been supplied, then we must look at all options of how we can fund our retirement. This may include, Pensions from employment, state pensions, savings, downsizing our property, Inheritance, just some of the options we have to build an income to sustain our standard of living.

*Allk figures based on sterling (GBP)

With the ever-increasing cost of goods, rise in inflation, interest rate rises and a vast increase in energy prices, we could all be forgiven if we are a little worried about the future and our financial livelihoods.

If we think about this, the real fear comes if we do nothing at all, certainly not an option if you are a working Expat. Some financial bodies recommend that employees save between 12 to 15% of their annual salary towards retirement. How many of us are doing that right now? So, with all the increases, both costs to save and cost of living, how can we resolve this issue?

Our advice is to review what you have at least twice a year continually. Stay up to date with the cost of everything, the rate of inflation and interest rates; these will all have significant impacts on your retirement fund.

Stay in touch with your adviser; how are your individual plans doing? Have you made sure that they are still on track to meet your retirement goals? If not, then what do you need to do to bridge the gap?

This constant analysis will make sure that you are fully informed and have a real handle on your ability to retire comfortably, or if not, you know what requirements are needed to save more to fulfil your dreams.

So, think about the goal you set yourself for retirement and the income you might need. What is the figure that you need? How do you get there, and what amount can you safely withdraw to maintain the “Retirement Pot” for a healthy income?

Experts state that around 4% per annum would be a realistic figure to withdraw each year, the more conservative state 3%, so plan yours now and talk to Corestone; if you are unsure what awaits you in retirement, we can help guide you with a clear path to your financial future.